AIIB to invest $200 mn in NIIF

Why in the news ?

- The Asian Infrastructure Investment Bank (AIIB) has approved an investment of $200 million in the National Investment & Infrastructure Fund (NIIF) to give a greater momentum to mega infrastructure projects.

More on news

- This is the first time that India is hosting the annual meeting of AIIB, which would be addressed by Prime Minister .

- The third annual meeting would help us to learn from ideas and experiences of people from India and help shape the policies of the bank.

- India is the second largest shareholder in AIIB after China and is also the largest recipient of funds from the multilateral agency.

- According to the Ministry, nearly 25% of the total funds committed by AIIB have been committed for projects in India, both in the government sector and the private sector, which is a matter of great satisfaction.

- The Beijing-headquartered agency, which started operations in January 2016, has approved $4.4 billion investments so far, including $1.2 billion in India, making the country the largest beneficiary so far.

NIIF

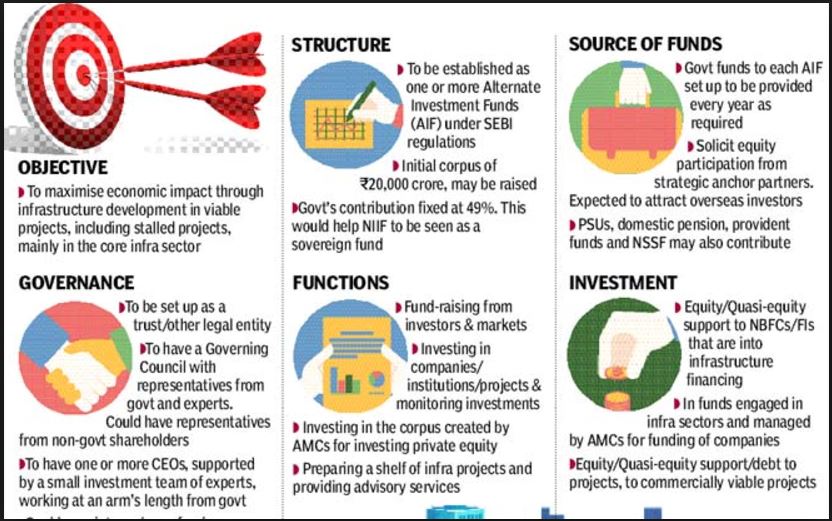

- National Investment and Infrastructure Fund (NIIF) is a fund created by the Government of India for enhancing infrastructure financing in the country.

- NIIF is jointly-owned by the Government of India (49%) and certain domestic and international investors (51%).

- The objective of NIIF is to maximise economic impact through infrastructure development in viable projects both greenfield and brownfield, including stalled projects, mainly in the core infra sector.

- NIIF has been structured as a fund of funds and set up as Category II Alternate Investment Fund(AIF) under the Securities and Exchange Board of India (SEBI) Regulations.

- The sources of funds for NIIF is the government budgetary funds to each AIF set up under NIIF. These funds will be provided every year as required.

- The fund will solicit equity participation from strategic anchor partners. It is also expected to attract overseas investors, PSUs, domestic pension, provident funds and NSSF (National small savings fund) also.

- The international pension funds and sovereign wealth funds from Singapore, Russia and the UAE have showed interest to invest under the fund.

- NIIF made its first investment, partnering with DP World (UAE) to create an investment platform for ports, terminals, transportation and logistics businesses in India.

AIIB

- The Asian Infrastructure Investment Bank (AIIB) is a multilateral development bank headquartered in Beijing.

- Like other development banks, its mission is to improve social and economic outcomes in its region, Asia, and beyond.

- The bank opened in January 2016 and now has 86 approved members worldwide.

- Its purpose is to provide finance to infrastructure development and regional connectivity projects in Asia-Pacific region.

- China is largest shareholder of AIIB with 31.02% voting shares. India with 8.72% vote share is second largest shareholder followed by Russia, Germany and South Korea.

Source

The Hindu, Indian Economy, NIIF