FPIs start process of falling in line

FPIs start process of falling in line

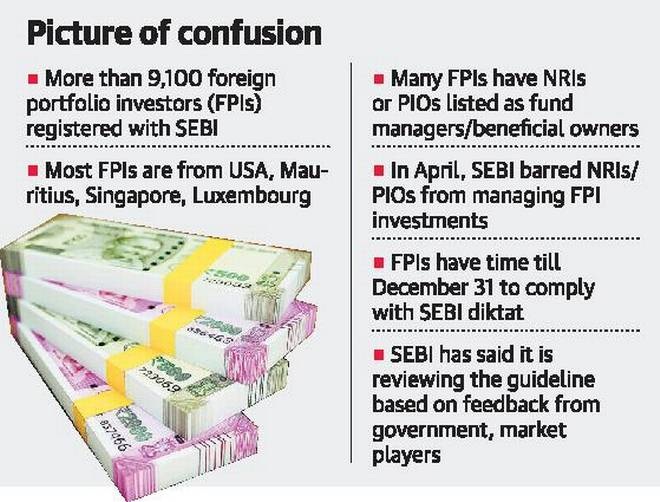

- Almost a dozen foreign funds across geographies such as Singapore, Mauritius and the U.S., which invest in the Indian equity markets, have started restructuring their ownership and management structure to comply with the Securities and Exchange Board of India’s (SEBI) diktat that bars Non-Resident Indians (NRIs), among others, from acting as fund managers of foreign portfolio investors (FPIs).

- According to people directly involved in the matter, some of the funds have initiated the process to change the key management personnel (KMP) managing the fund if such person falls in the category barred by the Indian capital market regulator.

- The recent past saw two funds – one each from Singapore and Mauritius – with a cumulative corpus of nearly $500 million, change their respective KMP even as SEBI had said that it would review the contentious circular based on the consultations with the government and various market participants.

- lawyers dealing with such investors said that many more funds had initiated corrective action to avoid any last minute compliance issues, as any change in the KMP or the fund manager required an approval from all the offshore investors and thereafter refiling of many documents.

- This was a time-consuming process.

To act or wait

- As per the SEBI circular, since the beneficial owner cannot be an NRI or OCI, it has pushed lot of FPI structures in trouble.

- Currently, there is lot of anxiety and dilemma among FPIs concerned, whether to act on the dictum now or keep waiting for a relaxation at least till the extended compliance deadline is round the corneri.

- NRIs, along with Person of Indian Origin (PIO) and Overseas Citizen of India (OCI), cannot manage FPI investments, and have time till December 31 to comply with the new framework.

- While an industry body has pegged the potential outflows at $75 billion due to the SEBI diktat, the regulator has brushed aside such concerns.

- The committee was extremely receptive to the practical problems arising from the circular. We are hopeful of a carve out of the problem areas

Source

The Hindu