Financial savings are up

Why in the news ?

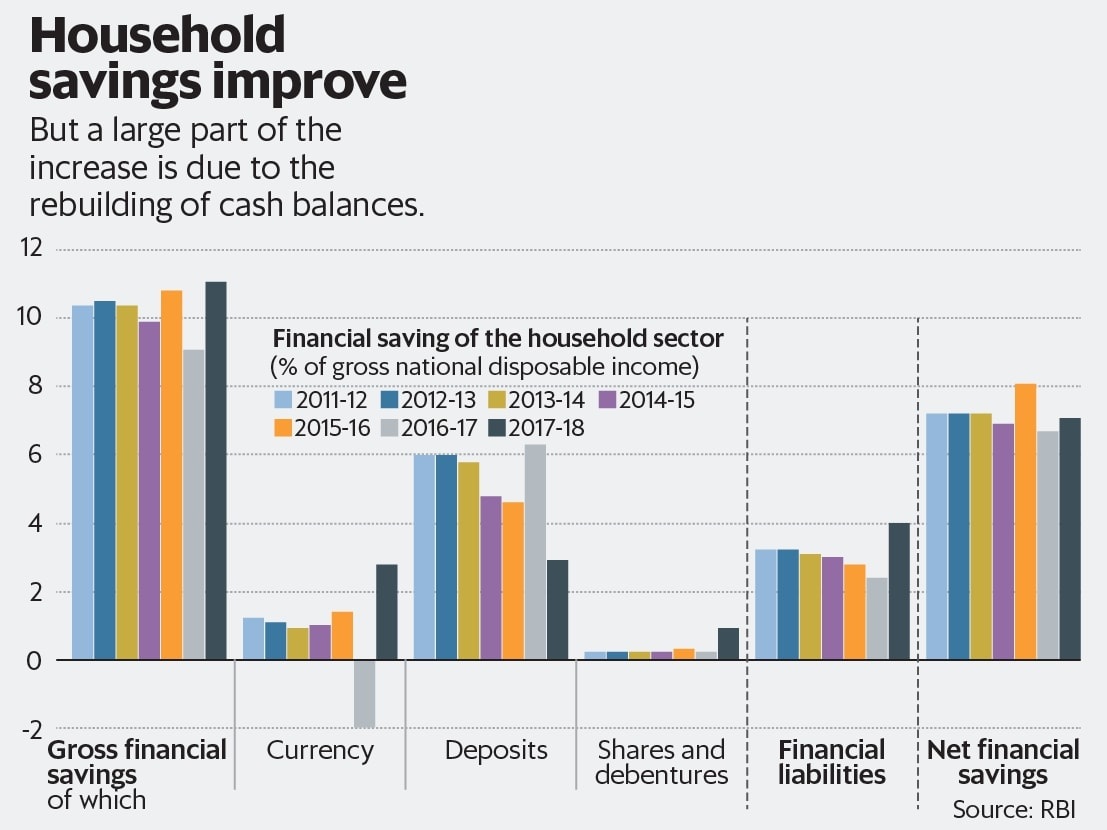

- The gross financial savings of the household sector, as a proportion of disposable income, saw a sharp rise in 2017-18, shows the RBI’s annual report.

Details

- Household financial savings as a percentage of gross national disposable income (GNDI) rose from 9.1% in 2016-17 to 11.1% in 2017-18, the highest in at least the last seven years.

- Indian households are traditionally known to spirit away their surpluses in land, property and gold, depriving the economy of capital for more productive uses.

- As the RBI report points out, household financial savings are the most important source of funds for investment in the economy.

- Therefore, data presented in RBI’s latest Annual Report showing that households sharply raised their financial savings in FY18 is cause for celebration.

- The bad news is that a major part of this increase was in currency.

- In FY17, bank deposits absorbed 70% of the incremental financial savings of households, or 6.3% of their disposable income.

- Demonetisation forced householders to take out their cash holdings and park it with banks.

- Had this trend continued, that have would meant more resources for lending to government and industry.

- But RBI data shows that, in FY18, households went right back to hoarding cash in their mattresses.

- The proportion of disposable income that went into bank deposits plummeted from 6.3% to 2.9% in FY18.

Source

The Hindu, Live Mint.