Half of farm households indebted: NABARD

Why in the news ?

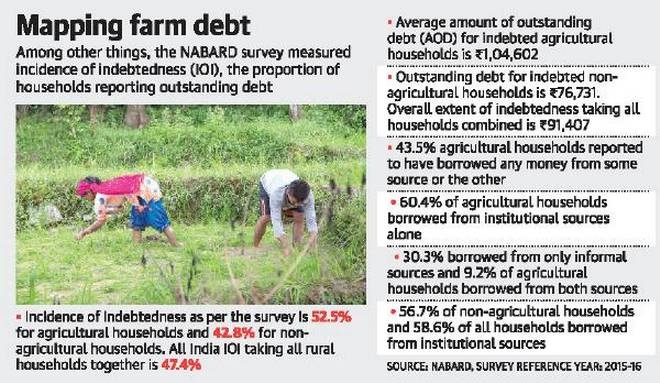

- According to a recent survey by the National Bank for Agriculture and Rural Development (NABARD), more than half the agricultural households in the country have outstanding debt.

More on news

- The NABARD All India Rural Financial Inclusion Survey 2016-17 covered a sample of 1.88 lakh people from 40,327 rural households.

- Only 48% of these are defined as agricultural households, which have at least one member self-employed in agriculture and which received more than Rs.5,000 as value of produce from agricultural activities over the past year, whether they possessed any land or not.

- Agricultural households reporting any outstanding debt also had a higher debt liability compared with non-agricultural ones.

- The survey found that only 10.5% of agricultural households were found to have a valid Kisan Credit Card at the time of the survey.

- The biggest reason for taking loans among agricultural households was capital expenditure for agricultural purposes.

- The southern States of Telangana (79%), Andhra Pradesh (77%), and Karnataka (74%) showed the highest levels of indebtedness among agricultural households, followed by Arunachal Pradesh (69%), Manipur (61%), Tamil Nadu (60%), Kerala (56%), and Odisha (54%)

Source

The Hindu